You want to use our APIs

We have a number of different endpoints to assist with quotation, pricing and eligibility checking for our insurance products.

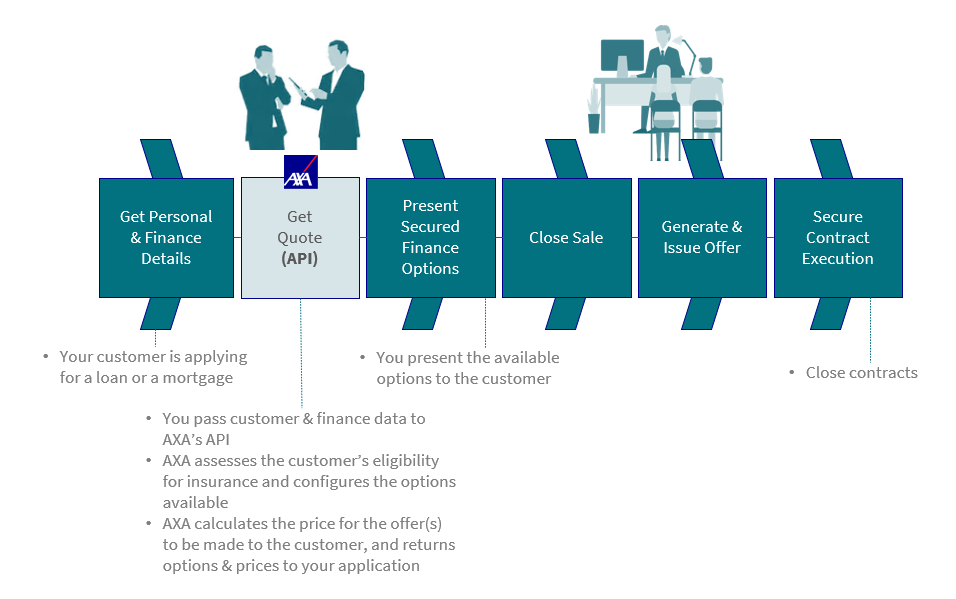

The quote API allows a number of different operations to be conducted. You can create a quotation, validate a quote eligiblity, select a quote, cancel a quote and finalise a quote.

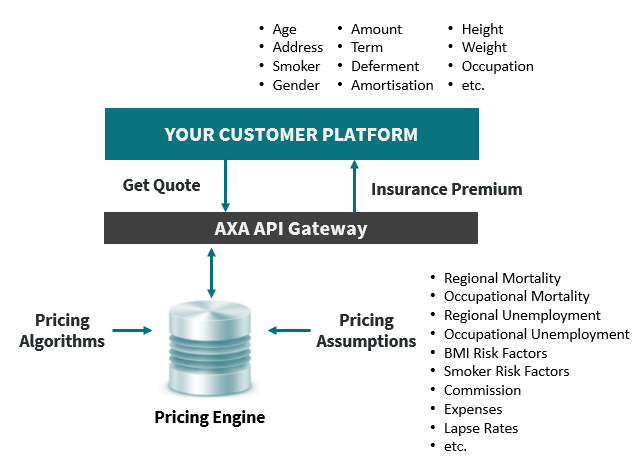

Our pricing API sits behind our quotation service and connects to our pricing engine. Here you can get an insurance premium, including check your customers eligibility to the product, get the associated fees to the initial premium, get a risk assessment, and finally get an updated premium following the risk decision (through DMS for example, see below).

We also have available a digital medical selection platform (DMS) that can be called to create medical risk assessment questionnaires and manage medical selection decisioning alongside capping regulatory rules to get the final premium the customer will pay.

The list of API below evolves according to our API First Strategy and the new use cases expressed by our partners through their customer journey.

So please feel free to consult your AXA Partners' point of contact.

Find out more

Explore our endpoints

- When targeting sandbox, anything will work (eg.

dummy/dummy) - When targeting production, real credentials will be required